Hall County mobile home taxes, as well as those for other counties across the state, are due April 1 this year, which is a month earlier than in previous years.

The mobile home due date is set by state legislation, according to a county news release.

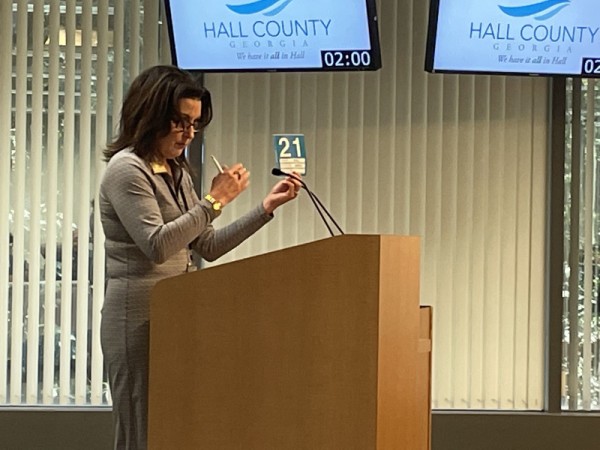

Hall County Tax Commissioner Darla Eden said Hall County has 4,911 non-homesteaded mobile homes; tax bills for those homes were mailed on February 1.

Mobile home owners are issued year-specific decals to display on their homes to show compliance after all taxes have been paid in full. The current year decal must be placed in a location that is visible from the roadway. If a mobile home does not have a current year decal, it may be subject to citation/fees by the Hall County Marshals’ Office.

Payments can be made online, in person, by mail or by using a drop box in front of the main doors at the Hall County Government Center.

Partial payments are accepted. However, to avoid the state imposed penalty of 10-percent of unpaid tax, the final payment must be postmarked on or before April 1.

If tax is not paid in full by June 1, the taxpayer is subject to additional tax lien and/or levy fees, which will greatly increase the amount owed. Once charges have been added, they cannot be waived by the Hall County Tax Commissioner’s Office per state law.

For more information, call 770-531-6950 or email [email protected].