GAINESVILLE - The first installment of Hall County property tax bills is due Oct. 1 but because the due date falls on a Saturday, Tax Commissioner Keith Echols will accept payments postmarked or paid by Monday, Oct. 3.

This is the first year property owners have the option to pay county taxes in two installments. At least half of the total must be received by Oct. 3 to avoid a charge of 1-percent interest per month. Taxpayers will not receive a second bill when the second installment is due Dec. 1. If the entire amount is not paid by Dec. 1, the taxpayer will be charged 1 percent interest per month until the bill is paid. Once the bill is 90 days late, a 10-percent penalty will be charged.

Of the county's 84,000 bills, 40 percent are paid from mortgage company escrow accounts, according to the Tax Commissioner's office. There are several convenient ways the other 60 percent of property owners may submit payment:

· Pay online at tax.hallcounty.org using Visa, Mastercard, Discover or e-check. (A bank processing fee is charged

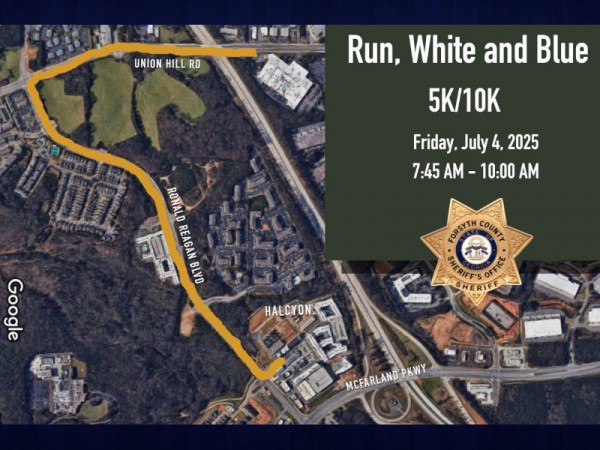

Friday

July 4th, 2025

9:05PM