ATLANTA - Delta Air Lines, Coca-Cola and Lockheed-Martin all announced first quarter losses Tuesday morning.

Delta, the world's biggest airline operator, said it was hit hard in the first quarter by the weak economy and bad bets on fuel hedges, but narrowed its net loss to $794 million.

The Atlanta-based company said it would immediately institute a $50 fee for most passengers to check a second bag on an international flight for travel beginning July 1. The company expects to generate more than $100 million annually from the new fee. Delta already charges fees for the first and second checked bags on domestic flights.

It also said that it will ground its entire fleet of 14 B747-200 freighter aircraft in its cargo unit effective Dec. 31, due to the age and inefficiency of the aircraft.

Delta said the loss for the three months ended March 31 was 96 cents a share, and compares to a loss of $6.39 billion, or $16.15 a share, for the same period a year ago.

Revenue increased 40 percent to $6.68 billion, but that was skewed by Delta's acquisition of Northwest Airlines in October. In the year-ago quarter, before the acquisition, Delta posted revenue of $4.77 billion.

Excluding special items, Delta said its first-quarter loss was 84 cents a share. Analysts polled by Thomson Reuters, who generally exclude one-time items from their estimates, expected Delta to post a loss of $1.01 per share for the first quarter on sales of $6.7 billion.

Delta, like other airlines, has been cutting jobs and capacity to weather the global economic downturn.

Delta previously said it will reduce international capacity by 10 percent beginning in September. As a result, in the December 2009 quarter, Delta expects system capacity to be down 6 percent to 8 percent and international capacity to be down 9 percent to 11 percent, year-over-year.

Elite frequent fliers and active military are exempt from paying Delta's new fee for a second checked bag on international flights. The first checked bag on international flights remains free.

Delta said it posted $684 million in realized fuel hedge losses in the first three months of the year. As oil prices soared to $147 a barrel last July, many airlines hedged a portion of their future fuel needs. When market prices came tumbling down in the months that followed, some airlines were stuck with those hedges and had to pay higher prices for a portion of their fuel.

Delta ended the quarter with $5 billion in unrestricted liquidity, which was unchanged from the balance at Dec. 31, 2008.

COCA-COLA

Coca-Cola Co., the world's largest beverage maker, said Tuesday that its first-quarter profit fell 10 percent on restructuring charges and write-downs but the results met analysts' estimates.

The Atlanta-based company, which has been focusing on core brands like Sprite and Coke amid a consumer spending pullback, says five extra selling days helped its quarterly results. It also maintained a plan to save $500 million a year by 2011.

``While the global economic environment remains challenging, we are well-positioned for long-term growth. Our business was built for times like these,'' President and Chief Executive Muhtar Kent said in a statement.

Kent has remained optimistic about Coca-Cola's prospects during the downturn, indicating at a conference in February that the company would emerge from the global financial crisis stronger than it went in.

Coca-Cola's net income for the period ended April 3 slipped to $1.35 billion, or 58 cents per share, compared with $1.5 billion, or 64 cents per share, a year ago.

Excluding restructuring charges, write-downs and other items, earnings were $1.51 billion, or 65 cents per share, which met the expectations of analysts polled by Thomson Reuters.

Quarterly results included a 2 percent rise in unit case volume, with some of the biggest improvements reported overseas in countries such as India, China and Mexico.

Sales dipped 3 percent to $7.17 billion to miss Wall Street's estimate of $7.36 billion.

Like other beverage makers, Coca-Cola has seen its sales drop as consumers grow increasingly concerned about the high-fructose corn syrup that sweetens their drinks. Drink makers hope advancements like stevia-based sweetener will help them stem declining sales and bring revenue growth back in line with population growth.

Rival PepsiCo Inc. made a $6 billion bid Monday to buy out its two largest bottlers in a bid to be more nimble as soft drinks have declined in popularity in favor of healthier options like water and juices.

Some analysts speculated that Coca-Cola which owns 35 percent of its largest bottler, Coca-Cola Enterprises Inc. may make similar moves since it faces the same challenges as Pepsi. In its statement Tuesday, Coca-Cola attributed part of its success to its ``alignment with our invaluable bottling partners.''

LOCKHEED MARTIN

Lockheed Martin, which has a huge aircraft manufacturing plant in Marietta, says its first-quarter earnings fell nearly 9 percent as growing pension costs more than offset higher sales of missiles, satellites and government information technology.

The Bethesda, Md.-based defense contractor earned $666 million, or $1.68 per share, down from $730 million, or $1.75 per share, in the year-ago period. Revenue inched up about 4 percent to $10.4 billion.

The earnings beat analyst forecasts of $1.64 per share but revenue missed a consensus estimate of $10.5 billion.

Pension costs reduced earnings per share by 19 cents in the latest quarter, according to the company.

Lockheed Martin Corp. also raised its 2009 earnings-per-share outlook due to a reduction in its number of shares outstanding.

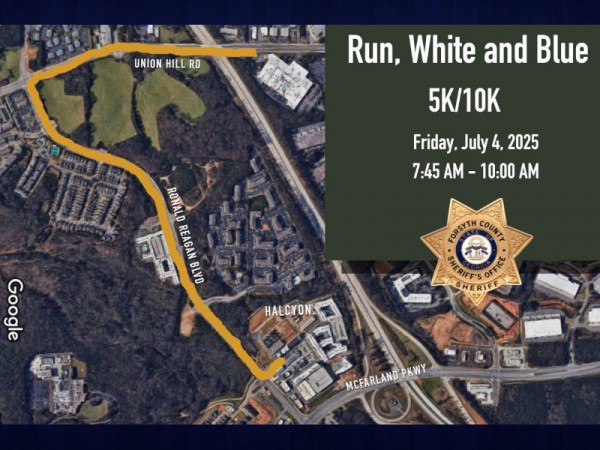

Friday

July 4th, 2025

8:55PM