GAINESVILLE - Hall County got a clean bill of health from the auditors during Monday's commission work session.

Auditors from Bates, Carter and Company reported that while Hall County income was lower than some counties, the overall long term debt was lower, funding reserves were good, and tax revenues were high.

Commissioners were happy to learn that Hall County has a lower millage rate than neighboring counties.

Auditor Beth Grimes reported that Hall County had seven mills in the tax year 2000, with other counties posting millage rates reaching up from 17 to 26 mills.

"Overall, a very strong and healthy county," said Grimes.

"Hall County is very fortunate that the local option sales tax,the special purpose local option sales tax,and the other tax revenues are coming in at the clip that they are,"said County Commission Chairman Gary Gibbs.

Hall commissioners plan to look closer at a five step process to implement impact fees at their winter work shop next week.

Assistant County Manager Phil Sutton said the commissioners have to approve phase three of the impact fee study for Hall County.

The second step is to set up an advisory committee to meet with the commission and hold public hearings.

Based on the current growth rate,impact fees, fees charged to contractors and developers, could amount to four million dollars a year in Hall County.

It does not happen often, but it does happen.

Hall Commissioners acted to correct a zoning permit mistake during their work session Monday.

County Commission Chairman Gary Gibbs said property holder Linda Pratt was given the wrong zoning classification by the planning and zoning department for her modular home on Cobb Griffin Road.

Gibbs said the corrective re-zoning would not harm the neighborhood, and Pratt's modular house is top quality.

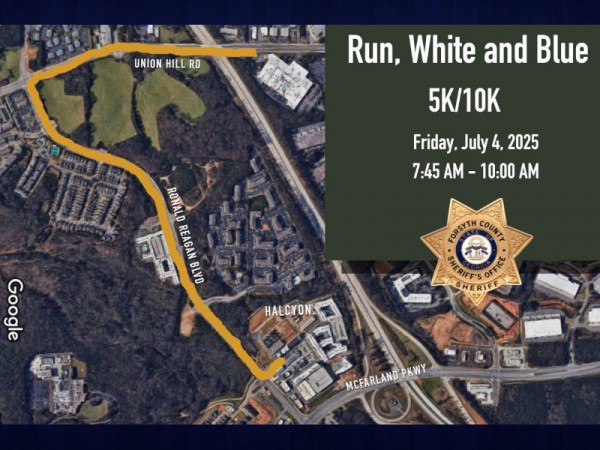

Friday

July 4th, 2025

4:25PM