ATLANTA (AP) — Georgia's Republican lieutenant governor is renewing a push to expand child care tax credits.

Lt. Gov. Burt Jones told The Associated Press on Tuesday that a Senate ally has introduced a bill to create a state income tax credit of up to $250 for every child under age 7, expand an existing tax credit for child care to give parents up to $300 more per child, and let employers claim a larger credit for investing in an on-site child care center.

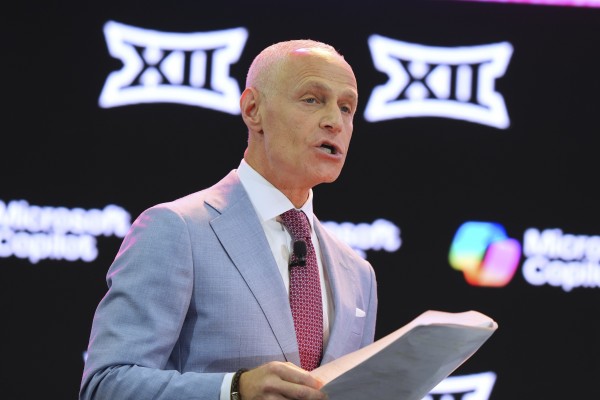

Jones has made those items part of his agenda as he is considering a run for governor in 2026. Much of what Jones has done since taking office in 2023 has been to cater to a Trump-aligned conservative electorate in a potential Republican primary. But he's also made some moves, often centered on protecting or aiding children, to build a record appealing to the broader electorate that would vote in a general election in politically competitive Georgia.

“We must do more to ensure that Georgia’s workers have access to affordable and quality child care,” Jones told the AP in a statement. “Child care is critical, not only for childhood development, but also for Georgia’s economy. The proposed legislation will help families who are struggling to afford the cost of childcare and will encourage more businesses to offer child care as an employee benefit.”

Jones' announcement comes after Democrats proposed even more generous breaks, a $200 child tax credit for all children under 17 and a child care tax credit worth up to the total amount a parent spends on day care, preschool, after-school care or summer programs.

“Affordable child care is essential for working families and a strong economy,” said House Democratic Whip Sam Park of Lawrenceville, a longtime proponent of more tax relief. “These tax credits ease the burden on parents, help more families access quality care, and ensure no one has to choose between work and caregiving.”

Tax credits allow someone to reduce their tax bill by a dollar for every dollar of the tax credit, and are more valuable than a tax deduction. However, in Georgia, tax credits can only be used up to the limit of someone's tax bill. A taxpayer who owes little or no state income tax can't get money back. Park, who favors a money-back option called a refundable tax credit, said a legal opinion stated that giving money back above what someone owes in taxes would violate the Georgia Constitution's ban on giving gifts of money to people or corporations.

There's already a federal child tax credit of up to $2,000 per child for those under 17, but Georgia has not had its own credit. Staffers for Jones said a formal estimate of how much tax revenue the state would give up hasn't yet been requested, but based on an estimate for a different child tax proposed by House Democratic Minority Leader Carolyn Hugley of Columbus, Jones' proposal could cost $100 million to $200 million.

Right now, Georgia's existing child care tax credit lets taxpayers take a credit of up to 30% of the amount they can get off from their federal income taxes for qualifying child care expenses. The federal ceiling is $3,000 per child, which means the Georgia ceiling is $900 per child. Jones' plan would increase that to 40% of the federal ceiling, or a maximum of $1,200. That would cost an estimated $10 million to $15 million more a year over the $40 million in revenue the state already goes, according to Jones' office.

The Jones plan would also increase the tax benefits to employers when they invest in building, remodeling or equipping a child care center. Right now an employer can take a credit of 50% of the spending off their corporate income tax, while the plan would increase that credit to 75%.