DALLAS (AP) — The CEO of Southwest Airlines said Wednesday he will not resign in the face of pressure from a hedge fund that wants him fired and that his leadership team will produce its own plan to boost the airline's financial performance.

CEO Robert Jordan said Southwest will present its plan in September. He declined to give specifics, but again hinted that it could include changes in the airline’s longstanding boarding and seating policies.

Elliott Investment Management notified Southwest’s board Monday that it bought a $1.9 billion stake in the Dallas-based company and is seeking to replace Jordan and Gary Kelly, the airline’s chairman and former CEO, with executives from outside the company.

Elliott accused Southwest leadership of failing to change with evolving customer tastes, causing it to lag behind rivals. The hedge fund noted that Southwest’s share price has fallen more than 50% over the past three years.

Another investment manager, Artisan Partners, said Wednesday that it has raised the same issues with Southwest, and it urged the airline's board of directors to “upgrade the company's leadership.”

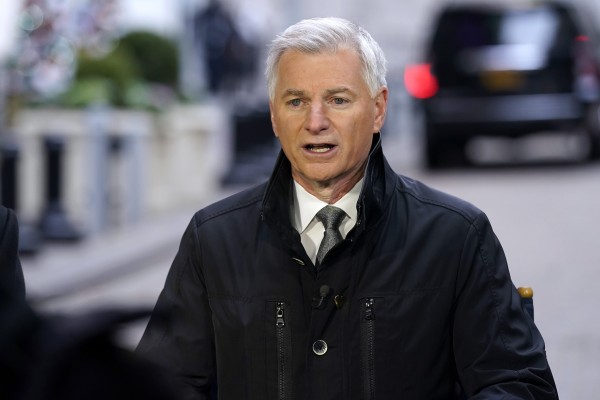

Speaking to reporters after a Politico event in Washington, Jordan said, “I have no plans to resign" and that Southwest will treat Elliott “like any other investor.”

“Elliott can provide us ideas. They can talk to other shareholders, but Elliott is not directing the company,” he said.

Jordan said Southwest is investing in better technology — critics blamed outdated systems for contributing to massive flight cancellations in December 2022. He said the airline is also improving the customer experience with better WiFi, larger bins for carry-on bags, and more power outlets.

Southwest is also considering changes to its cabin and seating, such as whether to sell some seats with extra legroom, Jordan said.

“We've got an investor day in September, and I'm eager to lay out a very broad plan for how we improve the company both from a customer perspective but from a financial perspective,” Jordan said. He added that an Elliott presentation aimed at Southwest shareholders was “fairly light” on ideas.

Elliott, whose stake in Southwest is estimated by analysts to be around 11%, declined to comment on the CEO's remarks.

Artisan Partners, which holds 1.8% of Southwest stock, according to FactSet, said Wednesday that it has made the same points as Elliott about the need for “dramatic change” to Kelly, the airline's chairman, in the past several months.

Two Artisan executives said in a letter to Southwest’s board that they were writing “to urge the board to reconstitute itself and upgrade the company's leadership. ... We believe this process needs to commence immediately.”