Trading on Wall Street was quietly mixed early Monday ahead of a set of highly-anticipated earnings reports from some of the nation's biggest retailers.

Futures for the S&P 500 rose just 0.1% before the bell, while futures for the Dow Jones Industrial Average fell back 0.1%.

Walmart, Target, Lowe's and The Gap all report earnings this week and should provide analysts another perspective on how American consumers are spending ahead of the holiday season.

A report Friday showed shoppers spent more at U.S. retailers last month than expected, suggesting consumer spending, the most influential force on the economy, remains solid.

Shares of Elon Musk's Tesla jumped 5.7% in premarket trading Monday after Bloomberg News reported that the incoming Trump Administration is prioritizing loosening regulations for self-driving vehicles.

Tesla, the electric vehicle company that made Musk the world’s wealthiest person, has had repeated skirmishes with the government regulators over recalls and other investigations. Earlier this month, the National Highway Traffic Safety Administration accused Tesla of telling drivers in public statements that its vehicles can drive themselves, conflicting with owners manuals and briefings with the agency saying the electric vehicles need human supervision.

The NHTSA has asked the company to “revisit its communications” to make sure messages are consistent with user instructions.

The AP reported last week that Musk’s super PAC spent around $200 million to help elect Donald Trump.

Chipmaker Nvidia fell 2.2% on reports that some of their AI chips have been overheating. Nvidia reports its latest earnings on Wednesday.

Elsewhere, in Europe at midday, Germany's DAX lost 0.3%, while the CAC 40 in Paris edged 0.2% lower. Britain's FTSE 100 fell 0.1%.

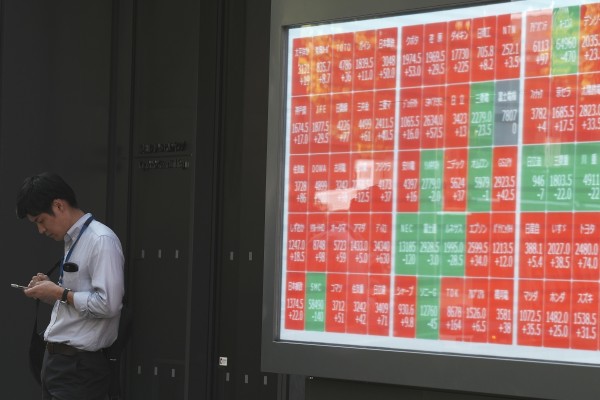

In Asian trading, Japan's Nikkei 225 index dropped 1.1% to 38,220.85 as the yen initially regained some strength against the U.S. dollar after the central bank governor, Kazuo Ueda, indicated that the Bank of Japan will continue to raise interest rates as conditions permit.

The dollar climbed to 155.31 Japanese yen from 154.54 yen late Friday. It had been trading above 156 yen last week.

South Korea's Kospi jumped 2.2% to 2,469.07 after Samsung Electronics, the country's biggest company, announced a share buyback plan. Samsung's shares jumped 6%.

Chinese markets were mixed. The Hang Seng in Hong Kong added 0.8% to 19,576.61, while the Shanghai Composite index shed early gains to close down 0.2% at 3,323.55.

Elsewhere in Asia, Australia's S&P/ASX 200 edged 0.2% higher, to 8,300.20. Taiwan's Taiex lost 0.9% and the SET in Bangkok picked up 0.7% as the government announced that Thailand's economy grew more than expected in the last quarter.

In other dealings early Monday, U.S. benchmark crude oil added 35 cents to $67.37 per barrel in electronic trading on the New York Mercantile Exchange. Brent crude climbed 47 cents to $71.51 per barrel.

The euro bought $1.0539, up from $1.0534 late Friday.