The Internal Revenue Service has issued some last minute tax filing tips for those who might not have had the chance to file their returns yet this year.

Mark Green, a spokesman for the IRS in Georgia, said one of the easiest things you can do is use their electronic filing method, because you don't need to hire a tax preparer or even leave your home, not even to go to the post office or mailbox.

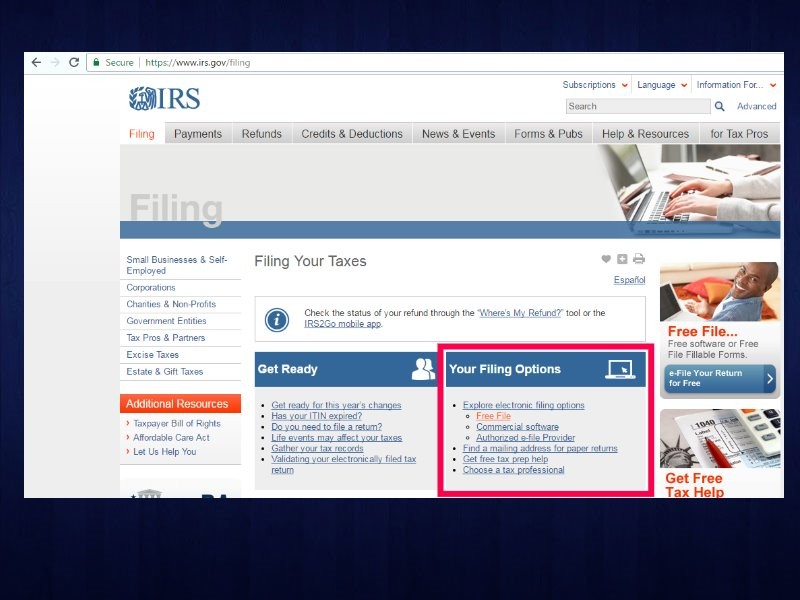

"This is a user-friendly product. More and more Georgians are taking advantage of this because they know how simple it is. We will ask you questions and in turn input the information, we will process the tax return, file it electronically for you," Green said. The system will notify you by email if there is an error within 48 hours, and Green said it cuts out the middle man, saving you time and money. "It's free if you come through us. Just click 'Free File' on our website, IRS.gov."

If you prefer to paper file, Green said before you seal any envelopes to be 100% sure documents are signed and dated, as well as double check your math.

Ahead of filing a return - electronic or paper - Green encourages Georgians to gather all their documents before starting the filing process. That includes W-2's, 1099's, a 1098 if you own a home, as well as your Social Security Number and the SSN for your spouse or dependents.

Green said one of the biggest problems the IRS sees with returns is not bad math - it's not filing at all. "Individuals are afraid. They think they owe money, they'd rather not bother with, so to speak. The most important thing to do is, by April 18 midnight, file something," Green said. "By filing a return, you at least save yourself from getting a failure to file penalty... or request an extension." Green said if you owe money, pay as much as you when you file your return or, reach out to IRS customer service to work out a payment plan.

If you didn't file in 2013, you may be one of the 34,000 Georgians to have unclaimed funds. "They're missing out on 32 million dollars in unclaimed refunds. That's just in Georgia. 32 million dollars for tax year 2013. So, definitely encourage mom, dad, to look at the little one's W-2's if they worked that year, if there's any withholding - check and see, and they can file a return by April 18 at midnight in order to claim a portion of that money," said Green.

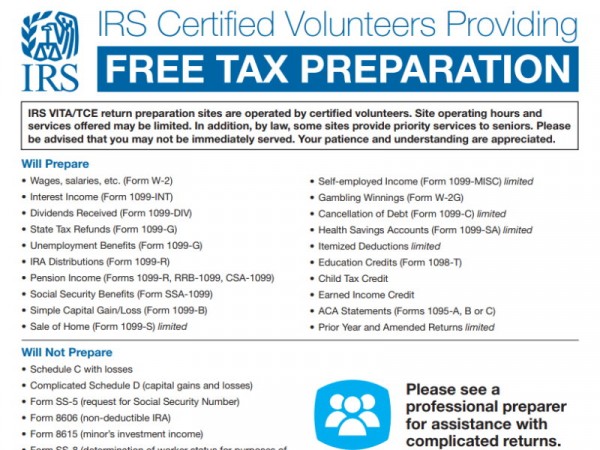

If you need assistance filing your taxes still, either hire an accredited tax preparer or see if you qualify for assistance from the IRS itself.

South Georgians affected by the storms and tornados have more time to file a tax return this year. Citizens in Berrien, Cook, Crisp, Dougherty, Turner, Wilcox, Thomas and Worth County have until May 31, 2017.

Both natural disasters and tax season brings out phone scammers. Green said the IRS will most likely never contact you via the phone. "The IRS does not, and I repeat, does not contact you by email, text, social media... or the telephone stating that you owe money and if you don't pay you'll be arrested," Green said. "Nor do we ask you for your personal financial information, such as your checking account, savings account, nor do we ask you to go to a retail store and get a pre-paid debit card to pay the amount off immediately. Those are all scams."

Green also encourages those who receive phone messages claiming to be the IRS to contact local law enforcement, and if you're ever uncomfortable on the phone speaking to an IRS agent - or someone pretending to be one - Green said to just hang up.

Lastly, Green urges Georgians to file anything, whether it is a return or an extension request, by midnight, April 18.

Editor's Note: April 18 is an extra special day for IRS spokesman Mark Green as it is his retirement! Green has worked for the IRS for the past 31 years.