UNDATED - Slumping tax collections and budget cuts have Georgia and Alabama scrambling to pay tax refunds before a Wednesday deadline requires them to begin paying interest for tardy refunds.

The longest U.S. recession since World War II has caused tax collections in Alabama and other states to drop, shrinking state revenues and forcing staff cuts. And that has led several states to delay refunds to late summer and even fall.

Alabama and Georgia have 90 days after the April 15 filing deadline to issue refunds to taxpayers who filed correct tax returns in time. If the states don't make the 90-day deadline - which is Wednesday - they have to pay interest to the taxpayers.

In Alabama, it's 4 percent annually; in Georgia, it's 1 percent monthly.

"It appears we may have to," Reg Lansberry, spokesman for the Georgia Department of Revenue, said Monday.

Alabama Revenue Commissioner Tim Russell said Monday the state originally expected it would have to pay interest to some taxpayers, but it now appears tax collections will be sufficient to get all refunds issued by Wednesday.

That happened because Gov. Bob Riley took $100 million out of a state rainy day fund as allowed by law.

Neither Alabama nor Georgia has had a tax refund problem equal to California's.

California officials say they expect to issue IOUs this month to individuals for $140 million in tax refunds and to businesses for $58 million. The state plans to redeem the IOUs in October, but in the meantime, it will owe 3.75 percent annual interest.

Kansas had also been slow paying tax refunds, but last week Kansas officials approved a plan for internal borrowing that allowed it to catch up on 35,000 tax refunds, totaling $31 million, that had been delayed a month.

Alabama's July 15 deadline for issuing tax refunds became an issue this year because the state's individual income tax collections through June were down 8 percent from the same period a year ago. Corporate income tax collections were off 11 percent.

In addition, Alabama's tax refunds are running 24 percent higher than last year, largely due to taxpayers claiming large capital losses, Russell said.

With the cash-flow problems, Alabama had been expecting not to have 43,713 refunds totaling $35.6 million issued by Wednesday's deadline. But Russell said late Monday afternoon it now appears the state will have the money to meet the deadline and avoid interest payments.

In Georgia, the Department of Revenue's delays were caused by nearly 280 layoffs resulting from budget cuts. In the last two weeks, the department added 70 employees to speed up the processing of tax returns.

Tax officials say that more than 270,000 returns filed on time are still awaiting processing. Officials are unsure how many will start drawing 1 percent monthly interest after Wednesday.

Lansberry said the department should have a clearer picture Thursday.

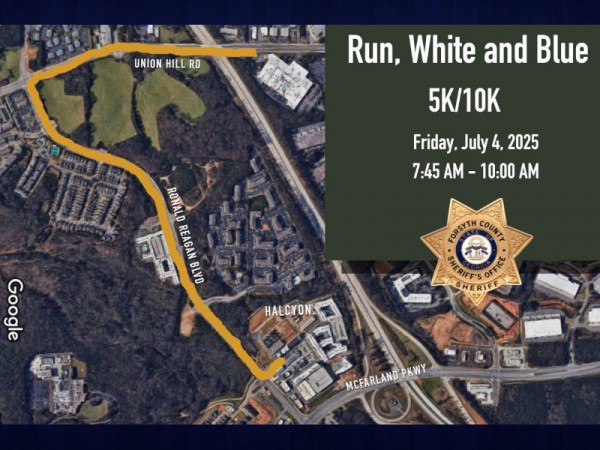

Friday

July 4th, 2025

7:17AM