LONDON (AP) — The Bank of England kept its main interest rate at a near 16-year high Thursday as inflation remains too high for comfort, and like the U.S. Federal Reserve a day earlier, it gave no signal that it is close to cutting borrowing costs anytime soon.

In a statement, the central bank said it had maintained its key rate at 5.25%, where it has stood since August of last year. The nine-member Monetary Policy Committee was split, with two voting for a quarter-point increase and one voting for a quarter-point cut.

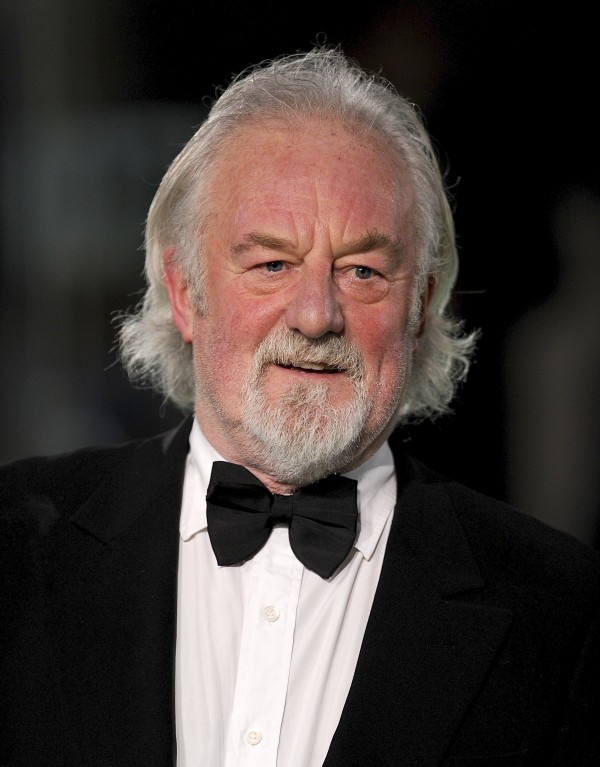

There had been “good news” on inflation in recent months, bank Gov. Andrew Bailey said, but at 4%, it's still double the bank's goal.

“We need to see more evidence that inflation is set to fall all the way to the 2% target, and stay there, before we can lower interest rates,” he said.

According to economic projections published alongside the rate decision, the Bank of England expects inflation to fall to 2% between April and June, about 18 months earlier than previous forecasts. However, it expects inflation to carry on rising as wages remain high and oil prices recover.

Overall, it indicated that monetary policy will remain “restrictive for sufficiently long” to ensure inflation returns to its target and stays there. That's code that interest rates will stay at current levels, or higher, until the bank is convinced inflation will settle down to 2%.

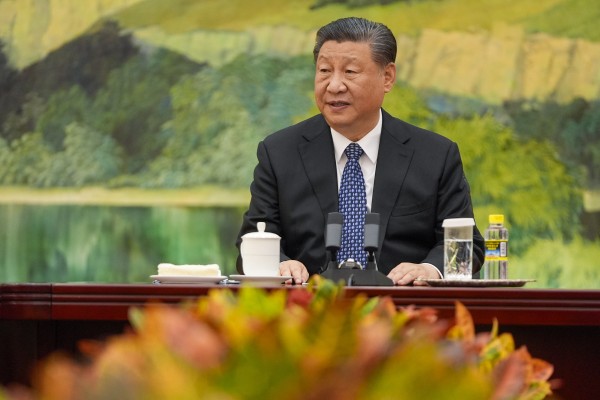

Similarly on Wednesday, the Fed held rates steady but surprised financial markets with its cautious statement that it “does not expect it will be appropriate” to cut rates soon.

The Bank of England, like the Fed and other central banks around the world, raised interest rates aggressively from near zero to counter price rises first stoked by supply chain issues during the coronavirus pandemic and then Russia’s invasion of Ukraine, which pushed up food and energy costs.

In December, inflation in Britain unexpectedly rose to 4%, an increase that tempered market expectations that the central bank would cut borrowing costs as soon as May.

“It’s hardly surprising that inaction is the order of the day, given that inflation ticked up in December,” said Susannah Streeter, head of money and markets at stockbrokers Hargreaves Lansdown. “It hardly set the stage for an interest rate cut.”

Higher interest rates — which cool the economy by making it more expensive to borrow, thereby bearing down on spending — have contributed to bringing down inflation worldwide.

Though a predicted recession has not materialized over the past year, economic growth is muted as high rates hold people back from borrowing to buy houses or invest in businesses.

The backdrop is hardly ideal for the governing Conservative Party ahead of a general election in the coming year. Opinion polls point to a big victory for the main opposition Labour Party.