Despite a joint statement released by both the county’s political parties opposing it, Habersham County leaders hope voters will approve the 1-cent roads and bridges tax on the Nov. 8 ballot.

If approved, funds collected through a single-county transportation Special Purpose Local Option Sales Tax (also known as a roads and bridges tax) can be spent for transportation purposes, including roads, bridges, public transit, rails, airports and buses, and all accompanying infrastructure and services necessary to provide access to those transportation facilities.

Leaders estimate $44 million would be generated in Habersham County by the local roads and bridges Special Purpose Local Option Sales Tax, with the county’s portion being roughly $34.5 million and the cities receiving the remainder.

The two primary funding sources for road maintenance and construction in Habersham County are SPLOST and Local Maintenance Improvement Grant.

The current six-year SPLOST includes an estimated $9.7 million allocated to road construction and maintenance, and bridge updates, repairs and replacement. That’s about $1.6 million per year.

The cost per mile for road resurfacing has increased from $112,348 in 2021 to $175,000 in 2022, cutting the 14.36 miles of resurfacing that could be done in 2021 down to 9.85 miles in 2022.

Additionally, culvert costs essentially have doubled from 2021 to 2022.

If approved by voters, the distribution of the roads and bridges tax after Habersham County’s $33,485,602 would be as follows:

- Alto – $514,921

- Baldwin – $1,990,819

- Clarkesville – $1,447,849

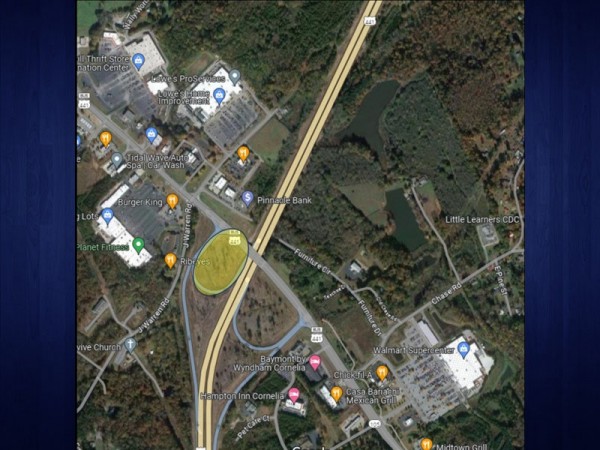

- Cornelia – $3,470,612

- Demorest – $1,714,704

- Mt. Airy – $1234,955

- Tallulah Falls – $140,026

That totals $43,999,560 to be spent on transportation infrastructure in Habersham County and its seven cities.

To qualify to hold a TSPLOST (roads and bridges SPLOST) referendum, a county must already impose a regular SPLOST. State law imposes a 2% cap on local sales taxes.

Single-county TSPLOST is in addition to those taxes and will not affect any other local sales and use tax and is exempted from the 2% sales tax cap.

Georgia law exempts a handful of items from taxation, including:

- Sale or use of jet fuel to or by a qualifying airline at a qualifying airport

- Sale or use of fuel that is used for propulsion of motor vehicles on public highways

- Sale or use of energy used in the manufacturing or processing of tangible goods primarily for resale

- Sale or use of motor fuel for public mass transit

- Purchase or lease of any motor vehicle.

Habersham County residents who have questions about the proposed roads and bridges SPLOST can join a Facebook Live at 1 p.m. Wednesday, Nov. 2, for a series of questions and answers hosted by Commissioner Bruce Palmer and Public Works Director Jerry Baggett.