GAINESVILLE - Gainesville and Hall County Tuesday settled, at least for now, the thorny issue of Local Option Sales Tax revenue distribution, thanks to a Georgia Supreme Court decision last week.

That decision made last Tuesday threw out binding or so-called 'baseball 'arbitration between cities and counties that could not agree on how LOST revenues should be split up, and Gainesville and Hall County could not agree.

County Commissioners and City Council held separate meetings to approve sending certificates of distribution to the State Revenue Department according to City Manager Kip Padgett.

"We approved the Certificate of Distribution to send to the Department of Revenue," Padgett said. "Right now everything's still fluid."

County Administrator Randy Knighton said the deadline to get the distribution certificates into the state to avoid losing about $26-million in annual LOST revenue is Thursday.

"Based on various factors including the Supreme Court decision last week, The ACCG (Association of County Commissioners of Georgia) and the GMA (Georgia Municipal Association) consulting with state officials, have requested that all jurisdictions provide a Certificate of Distribution by Thursday of this week," Knighton said. "The action that the county took earlier today is consistent with that direction."

Unlike the Special Purpose Local Option Sales Tax, which has a sunset provision, LOST is an ongoing penny sales tax and the Certificate of Distribution is supposed to be renegotiated between the county and its cities every ten years. Gainesville and Hall differed on how the revenue should be divided and went to court.

In the wake of the High Court's decision in a case involving Turner County and the City of Ashburn, the certificate sets the revenue split as its current level.

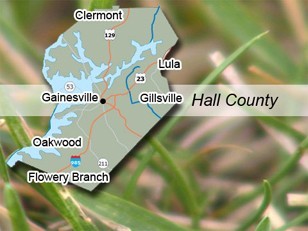

Hall gets the lion's share at 75.49 percent; Gainesville's share is 19.87 percent; Oakwood, 1.63 percent; Flowery Branch, 1.39 percent; Lula, 1.05 percent; Clermont, .44 percent; Gillsville, 0.09 percent; Buford, 0.03 percent and Braselton, 0.01 percent.

Saturday

April 20th, 2024

6:57AM

_p3.jpg)